Making the right Medicare decision can be overwhelming. After all, Medicare offers several types of plans and depending on where you live you may have different options. Not to mention, everyone has their own health insurance needs. Some are concerned with keeping premiums low knowing they will pay copayments and on the other hand, some may prefer the freedom of choosing any doctor without copayments.

There are countless rules and regulations involved. So many, in fact, that we tend to overlook important considerations. For example, we often forget that travel outside a Medicare service area can also be a factor.

We know, it’s a lot! That’s why SilverTone Med Plans was created, to help our neighbors avoid unwanted penalties and missed opportunities.

Below is a snapshot of the key components to the different Medicare plans. Please feel free to contact us directly for further assistance.

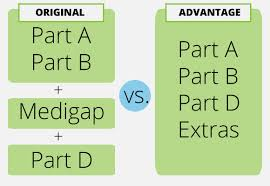

When looking for Medical and Prescription Drug coverage beyond Medicare Part A & Part B you have two options for additional coverage: Medicare Advantage or Medigap.

- Covers Part A, Part B and in most cases Part D Prescription Drugs

- Typically a Managed Care plan such as an HMO or PPO with office visit and hospital copayments

- Often include added benefits such as annual physicals, vision and gym discounts

- Lower premium rates when compared to Medigap plans.

- Provides coverage for charges not covered by Medicare Part A & B such as deductibles and coinsurance.

- Prescription Drug coverage is NOT included – a separate Part D plan is often needed

- Available through insurance companies with standardized plans

- Many different plans and copay levels available

- Plans use specific formulary lists so it is important to review your list by using the Plan Finder at www.medicare.gov

Your SilverTone Med Plans advisor can compare the plans in your area to help you make the right decision in choosing a plan that meets your health and financial needs.